4th April 2021, Manama, Kingdom of Bahrain – The International Islamic Financial Market (IIFM) announced the publication of its Perpetual Sukuk Al Mudarabah Tier 1 Standard Documentation Templates. The suite of standardized documentation consists of Prospectus, Master Mudarabah Agreement and Declaration of Trust.

The purpose of the Sukuk standard documentation templates is to provide the industry with a standardized set of documents addressing clauses that are repetitive, require transparency & clarity during the drafting of the Sukuk prospectus and related issuance documentation, while also standardizing definitions and updating Shari’ah requirements.

The Tier 1 Sukuk issuers, lead arrangers, legal advisors and other related parties will greatly benefit from this suite of standard documents as it will lead to efficiency and cost reduction in drafting of voluminous Sukuk documentation for issuers and offer greater transparency and comfort to investors.

IIFM Chairman, Mr. Khalid Hamad Al Hamad, said “Today IIFM has achieved an important milestone with the publication of Sukuk Al Mudarabah Tier 1 Standard Documentation. He added that conventional industry has greatly benefitted from the self-imposed rules and IIFM in its capacity is playing a same role in the orderly development of the Islamic industry.”

In his keynote speech, Dr. Adnan Chilwan, Group CEO of DIB Group, accentuated the significance of standardization in Islamic Capital Markets. “Standardization in structure and documentation of Sukuk allows for a buildup of confidence across the various stakeholders offering transparency along with a streamlined and quick transaction execution. Clearly, standardization of Sukuk documentation addresses the ability of the Islamic banks and sovereigns to access the Islamic capital markets in an agile manner. The IIFM Standard Sukuk Al Mudarabah documentation, which is based on international Shari’ah best practices, provides robust documentation that can be adopted seamlessly across all jurisdictions. Consequently, issuers will not only be able to ensure wider acceptability for their Sukuk, but will also be able to access the Islamic capital market in a time and cost efficient manner.

I am also of the opinion that multi-level stakeholders engagement is the need of the hour if we are to adopt measures that are aimed at deepening the Islamic capital markets.

As the Islamic finance industry braces itself to expand its outreach and charter new territories, it is appropriate for us to channelize our efforts through concerted and standardized solutions like the IIFM Standard on Sukuk Al Mudarabah, which can be efficiently integrated within our current practices, helping the industry transcend local and regional barriers while also providing the requisite impetus to support the growth of the Islamic capital markets.”

“This IIFM Sukuk Al Mudarabah Tier 1 Standard Documentation is a culmination of extensive industry assessment, market consultation, working group deliberation and Shari’ah guidance. Going forward IIFM also plans to work with the industry on developing additional Sukuk documentation standards as well as other Sukuk structures such as Senior (Unsecured) Mudarabah and hybrid Sukuk,” said Ijlal Ahmed Alvi, Chief Executive Officer of IIFM.

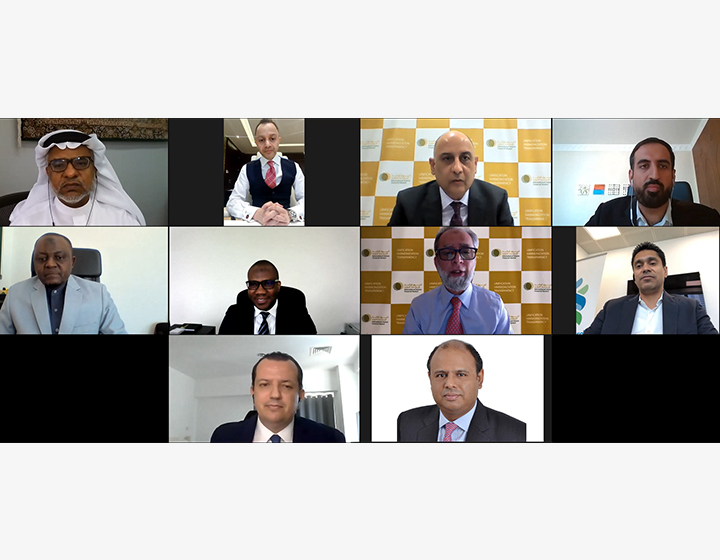

The Standards were launched at a special webinar event organized by IIFM where an international panel of experts representing IIFM, Abu Dhabi Islamic Bank, International Islamic Liquidity Management Corporation, Standard Chartered Bank Saadiq, Clifford Chance LLP and S&P Global Ratings spoke on the legal, operational, market, regulatory and Shari’ah aspects of the documentation and their benefit to users as well as the positive impact of the standards in development of the market. The market share and potential of Sukuk Al Mudarabah Tier 1 as well as other fast emerging hybrid structures were also discussed at the event.

More than 130 participants from around 84 institutions based in 23 countries attended the webinar launch event. The participants were representatives from financial institutions, multilateral institutions, regulatory bodies, stock exchanges, law firms, accounting & business advisory firms and educational institutions.

Mr. Alvi and Dr. Ahmed Rufai, Head of Shariah Compliance, thanked the esteemed and distinguished members of IIFM Shari’ah Board for their invaluable guidance, continuous support and their commendable efforts in correcting the path of Islamic banking and financial services industry. Thanks were also extended to Clifford Chance LLP for providing exceptional external legal counsel services, working group member institutions for their active involvement in the drafting and feedback exercise. Mr. Alvi also acknowledged the financial grants received from The Waqf Fund (Bahrain) and the National Bank of Kuwait (Bahrain) to enable the completion of this project.